Typically, states may hold tax refund offsets from a joint tax filer for up to six months before disbursing. When a case is submitted, texas will usually obtain child support from a tax refund offset within three weeks.

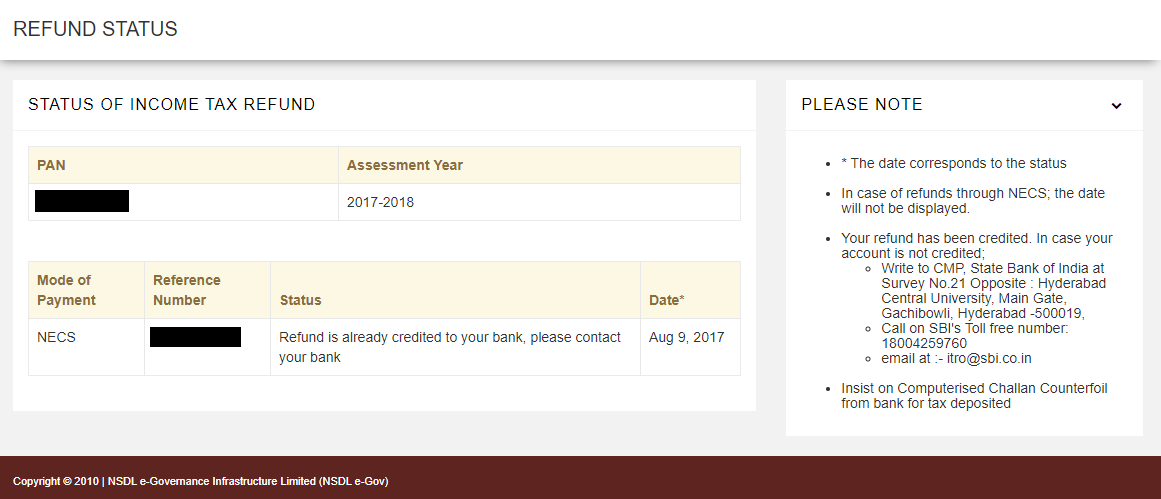

Income Tax Refund How To Check Claim Tds Refund Process Online

Filing this claim requires the following information:

How to stop child support from taking tax refund 2020. Are there any free tax preparation services? If you are owed child support and want to file for the program to have your child’s parents’ taxes potentially intersected, you can submit a form with the federal tax refund offset program. Log into your turbo tax return>take me to my return.

States can ask the irs to intercept, or offset, federal tax refunds for state tax obligations or money owed to state agencies: Examples of federal debts that might trigger offsets include federal income tax delinquencies and student loan defaults. If you overpay your income taxes and have an amount eligible for a refund, the state agency that governs your child support order has first claim to that refund if your support payments are unpaid.

It has long been the case that if you owe money, your federal income tax refund can be seized to satisfy your debt. However, most child support agencies. I called their automated line last year to test this out myself.

Posted on feb 10, 2015.read about if you need to lodge a tax return on the ato website.read more about child support and your family tax benefit part a. The state can continue to garnish tax refunds each year until all child support payment obligations are satisfied. The guidelines use a mathematical formula based on the combined income of the parents and other factors, such as any social security benefits the child is receiving on behalf of one of.

Your 2nd stimulus payment (approved january 2021) and 3rd stimulus payment (approved march 2021) cannot be garnished to pay child support. At the bottom left of your screen, go to >tax tools>tools> Suspend professional, drivers, occupational or.

You can claim qualifying tax credits of up to $6,660, these tax credits can help increase your tax return and possibly help quickly reduce your child support debt. The same rules applied to the first round of stimulus checks in 2020. You can be required to keep paying support long after your child’s an adult.the irs can enforce this by continuing to intercept your tax refunds.

In addition to the federal refund offset program, you may be subject to passport denial if you owe more than $2,500 in back child support. The irs program, volunteer income tax assistance (vita) offers free tax preparation services. If you’ve remarried, the irs may intercept a tax refund that's at least partially the result of your new spouse's overpayment of taxes to.

How to file for tax interception. They'll let you know if your refund has been flagged but will not disclose which agency flagged it. Another dramatic change stemming from the american rescue plan concerns the child tax credit (also known simply as the child credit).

Report your debt to credit collection agencies; Place liens on, or sell your property; When you’re delinquent on child support, your tax refund is typically intercepted and sent to the appropriate child support agency through the treasury offset program.

States can ask the internal revenue service (irs) to intercept, or offset, federal tax refunds The child support guidelines are the standard method for setting the amount of the child support and cash medical support obligations in the child support order. If you receive the special notice ( pdf) that your case will be certified for tax refund offset, you can:

In a previous blog, i pointed out that a change in the law made in late december affected the treatment of recovery rebate credits (rrcs) claimed on taxpayers’ 2020 income tax returns.unlike the advance payments issued to individuals last spring and in early january, the credit claimed on a 2020 tax return will be reduced to pay off certain outstanding debts. Should the funds come from a tax return jointly filed, it may hold the money for as long as six months before disbursing them. However, if the child support enforcement office doesn't collect child support funds on your child's behalf, then you need to petition the court to request it be collected this way.

As this refund is made under section 8aazlf, the registrar can use section 72 to intercept it to apply to the person's relevant debt. Federal law was tweaked in 2007 to make that clear. Under the cares act, your 1st stimulus payment (approved april 2020) could be garnished, but the rule.

To qualify for this program, you need to have been: For a refund to be subject to the “tax offset,” the child support The office of child support enforcement has the authority to seize your state and federal income tax refunds;

Employed during 2020, and had. Name of the parent who owes child support The offset will result in a $3,000 refund of the person's tax instalment deductions.

You need to a file an injured spouse form 8379 to protect your portion of the tax return. So, if you get a refund on your 2020 tax return because of the credit, the irs can take it away to pay any child support, state taxes, or other government debts you. If any of the above situations apply to you, you can call the irs to see if your account has been flagged for garnishment.

The state agencies could put a lien against your tax return for unpaid child support. That way, if your child's other parent falls behind on payments, the child support enforcement office will automatically report it to the treasury office to begin the process of intercepting tax refunds.

How To Find Your Irs Tax Refund Status Hr Block Newsroom

Faqs On Tax Returns And The Coronavirus

Can Child Support Be Collected From Tax Refunds A Texas Child Support Lawyer Explains - Attorney Kohm

I Owe The Irs Money What Happens If I Get A Tax Refund

11-year-old Gets 4 Cent Tax Refund From Inland Revenue But Cant Claim It - Nz Herald

Tax Return Delays Irs Holds 29 Million Returns For Manual Processing

Wheres My Refund - Track My Income Tax Refund Status Hr Block

Tax Refund Irs Says 28m Will Get Overpaid Unemployment Money Returned This Week Wgn-tv

Irs Is Holding Millions Of Tax Returns Delaying Refunds - Cbs News

Average Tax Refund May Surprise You

Stimulus Check Missing Some Waiting On 2nd Payment And Last Years Tax Refund Wonder If Problems Are Related - 6abc Philadelphia

Irs Delays The Start Of The 2021 Tax Season To Feb 12 - The Washington Post

Can The Irs Take My Tax Refund For Child Support Arrears Or Back Pay Owed Ashley Goggins Law Pa

3342 Best Tax Refund Check Images Stock Photos Vectors Adobe Stock

Wheres My State Refund Track Your Refund In Every State

Irs Is Holding Millions Of Tax Returns Delaying Refunds - Cbs News

Unemployment Tax Refund Update What Is Irs Treas 310 Weareiowacom

Tax Refund Garnished Due To Student Loan Default You Can Get It Back Student Loan Hero

When Will I Receive My Tax Refund Will It Be Delayed Forbes Advisor

How To Stop Child Support From Taking Tax Refund 2020. There are any How To Stop Child Support From Taking Tax Refund 2020 in here.